Listing process Regulated Market

Listing process Regulated Market General Standard

2. Listing process Regulated Market

Selection of IPO-experts / IPO-conception

Briefly, you have to do the following:

Select the IPO-experts who usually consist of

- an IPO-advisor,

- an issuing bank and a banking syndicate,

- certified accountants and lawyers as well as

- a PR-agency.

At the beginning of the IPO-process you work out an IPO-conception jointly with the IPO-counsel and/or the issuing bank, which serves as schedule leading to the ultimate object “IPO“.

General

An initial public offering (IPO) is a complex process requiring both practical as well as special technical knowledge. It is divided into a preparation stage, a planning stage and an actual process stage. On its way to going public, the company needs qualified partners during the different processes that render assistance in various ways. Therefore, for its IPO the company will seek the assistance of a team consisting of IPO-advisor, an issuing bank and further syndicate banks, certified accountants and lawyers as well as a PR-agency, if need be. In cooperation with part of their IPO-underwriters the company will prepare a project plan covering the complete IPO-performance, which determinates and structures its contents and arranges the time schedule. This IPO-conception forms the base for the cooperation of all persons involved in the project.

IPO-experts

Due to the complexity of an IPO, counselling in various areas performed by experts from different functional directions is required. As a rule, these are:

IPO-advisor

Often the IPO-advisor is the first contact point for the company planning to go public. Depending on the agreement concluded with the company, the IPO-advisor’s activities may be limited to a kick-off counselling or may cover the complete process. The IPO-counsel’s position is that of an independent counsel. In this function, the IPO-advisor might be in conflict with the issuing bank, for one, due to a possible interference of their areas of activity and, for another, due to the fact that the IPO-advisor is under no obligation towards the cooperating banks and can position the company in relation to the syndicate banks. In many cases it will be the IPO-advisor who takes over the management for the preparations along the way to going public and who assumes project management and coordination.

Above all, the possible fields of activity of an IPO-advisor are the following:

- review if the company meets the requirements for going public,

- review of the company strategy, the corporate planning and the management processes,

- assistance with compiling the company’s equity story displaying key skills, success factors and perspectives of the company,

- preparation of a fact book as well as a management presentation,

- preparation and assistance of the company in selecting the underwriting banks or other capital market experts (so-called “beauty contest“),

- project management and coordination of the cooperation between all the IPO-underwriters and the company and

- development of a first IPO-conception with benchmarks of the IPO-plans.

In addition, the IPO-advisor may support the company, if need be, even after the IPO in the course of public and investor relations activities.

Issuing bank and banking syndicate

Generally an IPO will be accompanied by a banking syndicate, i. e a consortium of several banks and/or financial services providers with one of the banks assuming the function of the syndicate manager. The leading issuing bank as well as the other underwriting syndicate members often are selected by means of a so-called “beauty contest“. The company provides several banks of its choice with information on the company, for instance in form of a fact book and a description of the company’s personal equity story, and invites the banks to apply for syndicate membership or for the syndicate manager position for the IPO in question. The banks and financial services providers will use the information on the company to gain a first evaluation of the possible success of an IPO with this company.

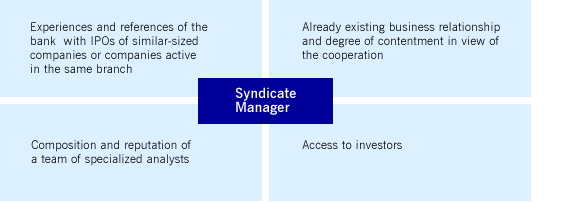

The company’s decision for a certain candidate as syndicate manager is of great importance and gives direction to the further success of the IPO. Therefore, the size of the institute should not bet he only criterion, but the company should consider in its selection also other matters which are listed in exemplary manner here.

In practice, the selection of the leading issuing bank and the composition of the banking syndicate will be directed to the objective of addressing a preferably wide-spread investor circle and to achieve an optimal offering price for the company’s stock.

The core functions of the issuing bank belong to the actual process stage. During this stage the responsibility of the syndicate manager reaches from the preparation of a detailed time schedule covering the complete IPO-process and the care for adherence to this schedule, to the performance of a thorough evaluation of the company (due diligence), to the company’s positioning on the capital market by means of the equity story up to the successful marketing and placement of the stock offered. Simultaneously, the issuing bank is involved in the preparation of the securities prospectus and leads the company through the subsequent stock market listing process from application submittal to the first price fixing.

In short, the syndicate manager’s functions, above all, are the following:

- review if the company meets the requirements for going public

- performance of due diligence and company evaluation

- preparation of a thorough IPO-conception including a detailed time schedule

- preparation of research and analysts’ presentations

- cooperation in the preparation of the securities prospectus

- marketing and placement of the IPO

- assistance during the complete process of admitting the securities for listing

- support of the issuer after the IPO.

For performing all of its functions the issuing bank relies on the company’s close and trusting cooperation.

Legal counselling

Lawyers may be involved at various times in the IPO-process. During preparation stage, the company might need to undergo restructuring measures under company law in order to meet the requirements for going public. In such a case, the supporting lawyers will assist the company, for example, with changing its legal form of organization to a joint-stock company or with modifications of its existing articles of association.

During the actual process stage, the preparation and performance of a legal due diligence is among the lawyers’ core tasks in the course of an IPO. The legal due diligence serves the purpose of checking the complete legal circumstances of the company and to discover and evaluate, as thoroughly as possible, any and all legal risks resulting from the issuer’s legal and business relationships. In this context, pending legal disputes will also be reviewed.

Finally, experienced lawyers will generally be involved in the preparation of the securities prospectus. Thus the company can safeguard that the contents of the prospectus will comply with all requirements set forth in the Regulation (EU) 2017/1129. After preparation of the prospectus, the lawyers will also assist the company during the approval procedure at the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) [German Federal Agency for Financial Market Supervision] and support the company at implementing the necessary prospectus supplements and corrections. After performing the due diligence and preparing the prospectus, the lawyers, if need be, will confirm to the syndicate manager or other parties involved in the process by means of a legal opinion, that the prospectus correctly and completely displays the legally relevant topics.

Certified accountant

Depending on the trading segment and transparency standard aspired, there are different requirements regarding the accounting standard of the candidate for flotation. Therefore, it might be necessary to involve the certified accountant into the IPO-process at an early stage already. In case of a public offering of securities the accountant will assist the company, for instance, already during the planning and preparation stage with the conversion form national accounting to IFRS-accounting required for Annual Consolidated Report or with reorganization measures performed by the company in advance, insofar as the preparation of financial information is necessary.

Further on, the certified accountant performs a thorough financial due diligence, in the course of which the company’s economic development so far as well as the economic development it intends to take in the future come under critical review. This review and the definition of chances and risks are entered in form of secured financial information and risk notices into the securities prospectus. Depending on the trading segment selected and the related transparency standard, the IPO requires the financial statements of preceding business years to be reviewed and provided with the auditor’s certificate and included in the securities prospectus.

Moreover, the certified accountant confirms, by means of a comfort letter towards the issuing bank the financial figures and financial statements contained in the prospectus. This comfort letter also serves as documentation of the individual review services performed by the accountant.

PR-agency

The public relations counsel (PR-counsel) manages in close collaboration with the candidate for floatation and the syndicate manager the communication processes with the important external target groups as well as the business and financial press media . An IPO centres the company into the focus of the capital market. As a result extensive requirements regarding the communication with investors, analysts and other participants of the capital market have to be met. The communication activities aim to increase the company’s awareness level on the capital market, to present the business activities into the context of market and competition and to position convincing arguments for a share investment. In doing so, the PR-counsel, in coordination with the company and the issuing bank, assumes the following functions:

- development of a communication strategy,

- participation in the development of an Equity Story

- preparation of a presentation for the road show,

- assistance of the company in press releases and ad hoc disclosures regarding the IPO,

- individual preparation of the management for appointments with media and investors,

- organization of an IPO-press conference,

- conception and implementation of a company’s investor relation-website,

- preparation of the company regarding an obligatory communication and the investor relationship work after floatation.

The PR-counsels offer also further services. For instance, they often support the company in the active media relations work as well as the coordination of management interviews with journalists, up to the complete organization of IPO marketing campaigns. Some PR-counsels offer the company’s public or investor relations services after the IPO has been concluded.

Deutsche Börse Capital Market Partner

For selecting the adequate IPO-underwriters, Deutsche Börse AG offers a network of experienced capital market experts, who can be recognized as Deutsche Börse Capital Market Partner. On the websites of Deutsche Börse AG you will find an up-to-date list of all Deutsche Börse Capital Market Partner, that are active in connection with admissions to the Regulated Market.

IPO-conception

The IPO-underwriters in their various responsibilities jointly develop a stock market listing conception which will be prepared in detail and set up in form of an IPO-conception. In this IPO-project plan all necessary processes and process steps are determined regarding both their contents and their timely sequence.

The IPO-conception means the compilation of all steps required for the IPO, individually adapted to the respective candidate for floating.

In the planning stage, the company in cooperation with the IPO-counsel and/or the issuing bank decides on basic conditions for the IPO, like the market segment targeted for the IPO, the transparency standard aspired, the issuing total volume, the stock market and, if need be, the class of stock. During preparation stage, the company’s equity story, financial requirements, application of funds, intended replacements, investor target group, stock market segment as well as employee profit-sharing schemes are recorded in the IPO-conception.

In short, the IPO-strategy contains in any case:

- a time schedule where the important steps of the IPO-process are set forth,

- the market segment and transparency standard fitting the company’s needs,

- an IPO-strategy to be presented to the capital market,

- the class of stock,

- the compilation of the banking syndicate,

- the course of events of the public offering or private placement,

- the investors circle to be addressed,

- the intended issuing total volume,

- the lock-up obligations (ban on sale affecting shareholders) and

- the intended date for the start of listing.

Some of the aforementioned topics will be explained below.

Time schedule

The IPO of a company, from the decision to go public up to the first price fixing, will take, depending upon how well the company meets the requirements for going public and how attractive it is for the investors, a time span of six to twelve months. The time schedule reflects the timely sequence of activities during the actual process stage. The individual process steps, however, will not necessarily happen one after the other, but may be performed partly simultaneously and may intertwine with each other.

A significant matter of the time schedule is that it allows for adequate time frames for the due diligence, for preparation and approval of the securities prospectus, for the preparation of a research study as well as for the pre-marketing, the road show and the determination of the offering price and, finally, for the admission procedure.

IPO-strategy

In order to achieve the objectives set forth in the IPO-conception, the company will discuss with its IPO-underwriters which strategies would lead to the most successful performance of the placement or the going public, respectively. Among these is the determination of the issuing volume and the investor target group to focus on. The procedure and the correct contents have to be fixed in detail and a convincing equity story has to be created displaying the company’s history as well as the chances for success the future holds for the company and its market environment. In order to provide evidence for the company history and its business prospects, the relevant financial figures are significantly important. The conclusive explanation of the application of funds raised through the IPO, e. g. for financing further growth, serves the purpose of a positive evaluation of the company as profitable financial investment. However, in the course of developing an IPO-strategy measures like replacements and lock-up agreements with existing shareholders after the IPO may be considered when deciding on the way to proceed.

Due diligence

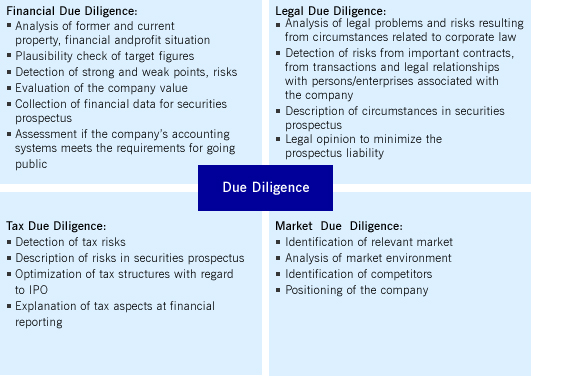

The due diligence is a thorough review and analysis of the company, above all, in view of its economic, legal, tax-related and financial circumstances. In the course of an IPO, generally a financial, a legal and a tax due diligence will be performed by the underwriters involved und by authorized external service providers in their respective field of expertise. An additional market due diligence analyses the company’s position in its market environment as well as its chances for growth. As can be seen, further basic conditions, too, like the well-functioning organization and communication in a company, but also its technical equipment and production processes will be included by interested investors into their investment decision; therefore, in these areas a due diligence might also be performed sometimes.

The financial due diligence analyses the past and present property, financial and profit situation of the company. This serve as base for a plausibility check of the company’s target figures. The business ratios and results found form the basis for evaluating the company value, which in turn is the source for important decisions for any party involved in the IPO-process. Furthermore, the financial due diligence serves the purpose of identifying important information for the securities prospectus. The company’s strong and weak points are uncovered; chances and risks can be pondered. Finally, the financial due diligence also helps with the analysis whether the company’s current accounting system meets stock trading requirements.

The legal due diligence helps to discover the legal problems and risks existing in the company. In practice, legal counsels will, for one, review relevant documents and, for another, hold talks with the company’s management. In the focus of this review are the corporate circumstances. However, also any significantly important agreements and transactions as well as legal relationships with associated persons form the subject of the legal due diligence. Analysed problem and risk areas may be removed in advance or adequately explained in the securities prospectus. Above all, the legal due diligence is especially important in view of the liability resulting from incomplete or incorrect information given in the securities prospectus.

In the course of a tax due diligence experts check the tax-related circumstances of the company and identify corresponding risks, which are explained in the securities prospectus. Moreover, this analysis serves the purpose of optimizing the structuring of the IPO as regards tax matters. Insofar tax consultants will often be involved in the IPO-process at a very early stage. The results gained from the tax due diligence also play an important role for the presentation of the company in the course of financial reporting.

By means of a market due diligence the issuer and the issuing bank obtain information about the relevant market and the competitors. The first step is the definition and identification of the market segment where the company performs its business activities. Afterwards, the market is analysed. Only after the market review has been completed, the company can be positioned within this market according to its characteristics. In a further step, potential competitors of the issuer are identified and the features distinguishing the company from its competitors are exposed.

Marketing and road show

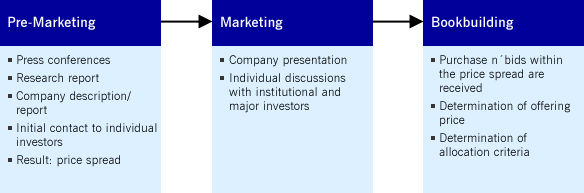

After an intensive internal preparation, the company, as the next important step, has to communicate its advantages and attractiveness to the market and the investors in order to win them as investors. This requires a targeted and well-planned stock marketing, which customizes the communication means employed to the respective target group.

In the course of an IPO, the most important marketing instrument is the road show. The management team accompanied by the underwriting banks travels from investor to investor to give a first-hand presentation of the company. Usually the road shows will mainly focus on the institutional investors as potential investors.

With the help of a especially prepared presentation, which extensively sets out the company’s business activities and has to be consistent with the securities prospectus, the executive board presents within about 20 to 30 minutes the equity story. Subsequently, the management is available for questions of the investors. Generally the management undertakes one-on-one interviews as well as group presentations. Thus, the potential investors will also get a picture of the trustworthiness of the company’s management as well as of the reliability an the long term capacity of the company strategy.

Depending upon the intended geographic spreading of the stock, investors at various national and international financial centres will be visited. In case of large IPOs such road shows may reach over several continents and take several weeks. This group receives first-hand information from the company in the scope of such roadshow interviews. In addition, the news coverage in the media offers an option to address further investors and to make them interested in a share subscription. Therefore, a good contact with journalists and analysts will prove helpful for the company in this context in order to place information on the market in a targeted manner and to generate attention regarding the emission. The analysts, above all, are of great importance, as they have the task of calculating fair stock prices and illustrating price potentials and price risks.

Internally, the executive managers and the employees of the issuer are an important target regarding the communication process. For one, employees of the company or of affiliated companies may through employee profit-sharing schemes directly hold an interest in the company and may be eligible to subscription. For another, they communicate in their environment on the IPO. Therefore, this investor and multiplier group ought to be informed and attended to in a timely and thorough manner in order to safeguard correct and adequate communication. Additionally, an IPO implicates directly wide changes for a company within the area of communication not at least regarding the regulatory requirements effected by it. Therefore, management and employees should be informed adequately in order to prevent violations of the insider trading ban of the German Securities Trading Act.

Besides the road show, the following measures, above all, can be considered as additional marketing instruments:

- Analysts conferences

- New letters to shareholders

- Interviews, press conferences and media placements

- The investor-relations-website

- Implementation of a call centre (especially for private investors)

- Presentation at investors fairs held by stock exchanges, stock exchange societies and shareholder associations

- Publication of annual reports

- Audio- and video web-casts

- General advertising instruments like advertisements and the like.

Contact Person

Issuer-Hotline

E-Mail: issuerservices@deutsche-boerse.com

Telefon: +49-(0) 69-2 11-1 88 88

Fax: +49-(0) 69-2 11-1 43 33

Related links

ISIN/Master Data

Briefly, you have to do the following:

- Apply for an ISIN

- Provide your master data

General

The ISIN is an international securities identification number (International Securities Identification Number) for stock and certificates representing stock as well as for bonds, options and futures. It consists of a twelve-digit combination of letters and numbers which clearly identifies each security. In cross-border securities trading, the ISIN functions, in a way, like the number inside an identity card which technically allows for both national and international tradability and settlement of securities transactions as well as securities custody.

Competent agency

The ISINs are allocated by central national agencies, the so-called “national numbering agencies“, In Germany the “Herausgebergemeinschaft WERTPAPIER-MITTEILUNGEN Keppler, Lehmann GmbH & Co. KG (“WM“) assumes the task of the national agency for allocation of securities identification numbers. The WM is a service company providing information for the financial world with its registered offices in Frankfurt am Main. Within the scope of their task as numbering agency, WM also performs the administration of securities identification numbers and data by means of a publicly accessible securities register containing any and all data existing at WM on issuers and their financial instruments.

WM Datenservice

Düsseldorfer Straße 16

60329 Frankfurt am Main

Tel: +49/69 2732 480

Application

An ISIN may be applied for by the issuer as well as by the syndicate bank. The ISIN is allocated in compliance with the ISO 6166:2021 - Financial services — International securities identification number (ISIN). This standard, for one, sets forth composition and structure of an ISIN, but, for another, also the requirements for allocation of an identification number. According to this standard, the allocation of an ISIN requires, among other things, certain minimum information on the issuer and the security; domestic issuers, for instance, have to provide an up-to-date excerpt from the commercial register and their current articles of association.

An iSIN is allocated upon respective application:

- as fax message to WM-WKN-Service: (0) 69/25 00 66 or (0) 69/24 24 84 76

- as Email to wkn-isin-de@wmdaten.com or wkn-isin-intl@wmdaten.com

The relevant application form for an ISIN can be found at the websites of WM Datenservice.

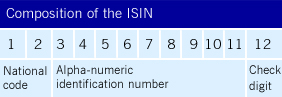

Composition of the ISIN

Pursuant to ISO Standard 6166, the ISIN consists of 12 digits in total. Two letters at the front serve as national code (see ISO Standard 3166). German ISINs start with the national code “DE“. Next is a nine-digit alpha-numeric combination which may consist of the capital letters A to Z (without mutated vowels, umlauts) as well as the numbers from 0 to 9. At the end there is a check digit calculated according to a determined algorithm.

Selection of a “favourite“-ISIN

As a rule, the ISIN will be allocated by the numbering agency according to a certain scheme. However, like selecting a special automobile number plate, it is also possible to apply for a favourite ISIN. In this case the core of the ISIN, the nine-digit basic number, will be allocated according to a sequence of numbers or letters or a combination of both individually selected by the applicant. The general rules for allocation, however, apply to this case also. WM Datenservice retains the right to deny without giving reasons the application for a favourite ISIN.

Details regarding this issue as well as the costs connected to it may be inquired directly at WM-Datenservice..

Contact: Help-desk@wm-daten.com, Tel: +49-(0) 69-27 32 480, catchword “Issuers Code”

Master data

The necessary data collected in the course of allocating an identification number which, similar to the particulars in a passport, serve the purpose of identifying the security are called master data. When applying for an ISIN, the applicant has to provide the numbering agency with all relevant master data referring to the security. Depending on the kind of security (e. g. stock or bond), these are, above all:

- ISIN/securities identification number

- issuer

- category

- stock market where the security is being traded

- state of origin

- currency.

These data will be collected by the numbering agency WM-Datenservice and provided in a publicly accessible register (WM-Wertpapier-Register [WM Securities Register]). When applying for an ISIN, the applicant also has to furnish the numbering agency with a copy of a current excerpt from the commercial register accompanied by a copy of the articles of association. In the time to follow, IWM Datenservice will need further information on circumstances following the issuance, like information on approaching general shareholders meetings, distribution of dividends or intended corporate actions. WM Datenservice will demand such data from the company based on the publications in the Bundesanzeiger [BANZ, German electronic Federal Gazette]; however, up-front information is considered very helpful.

Contact: Help-desk@wm-daten.com, Tel: +49-(0) 69-27 32 480

Helpful Information for Issuers of Securities

History

Since 1955 up to the implementation of the ISIN in April 2003, six-digit numeric securities identification numbers were issued in Germany for the identification of national securities. When in the middle of the 1980s more and more investors began to conclude securities transactions reaching across national as well as continental borders, frequent conversion of securities identification numbers to the securities identification used in the respective state became necessary.

In 1992 the organisation ANNA (Association of National Numbering Agencies) was founded by 22 national numbering agencies in order to further the option of issuing ISIN-numbers which already existed, however hardly were employed at that time. In this context, only three years later an electronic platform (GIAM = Global ISIN Access Mechanism) was created which provided for the exchange of ISIN-relevant data. The data base served the broader spread of the ISIN. After an expansion of the data platform in 1999, the platform served the purpose of bringing together worldwide data regarding ISIN-identification and making them accessible to other data suppliers.

In January 2000, the competent authorities in Germany decided to successively implement the ISIN as the new obligatory securities identification number. From the time of implementation on, already existing securities identification numbers either were continued additionally or transferred to an ISIN.

Calculation of the ISIN check digit

The check digit of the ISIN is calculated by means of a standardized algorithm (Modulus 10 Double-Add-Double):

- All the letters contained in the iSIN are replaced by numbers. For this purpose, the respective letter’s position within the alphabet is increased by nine. Thus A turns into the number 10, B into 11...and letter Z turns into number 35. All the numbers, however, remain unchanged. Therefore DE000ENAG99, for instance, turns into the digit sequence13140001423101699 and DE000BAY001 turns into the digit sequence 1314000111034001.

- Starting with the last digit, every second digit is multiplied by two and replaced by the cross total. Thus 13140001423101699 turns into the digit sequence 23240001826101399 and1314000111034001 into the digit sequence 1618000212064002.

- The digits of the resulting digit sequence are added up, i.e. their cross total is generated and the difference to the next higher number of tens is determined. This difference, if smaller than 10, will be the actual check digit or will result, should it equal 10, in a check digit 0. Therefore, for DE000ENAG99 or 13140001423101699, respectively, the cross total will be 51 and their ISIN-check digit will be 9 and for DE000BAY001 or. 1314000111034001, respectively, the cross total will be 33 and, thus, their ISIN-check digit will be 7.

Basic information for issuers

Please find information regarding the legal basis, the components, wording and further matters concerning the topic ISIN/ master data compiled under ”Basic Information”.

Related links

Prospectus

Briefly, you have to do the following:

- Prepare a prospectus in cooperation with the issuing bank and, if need be, legal counsels and certified accountants

- Submit the prospectus at “Bundesanstalt für Finanzdienstleistungsaufsicht“ [German Federal Agency for Financial Market Supervision] for approval

- Publish the approved prospectus prior to the start of the public offering or the admission to stock exchange trading, respectively

Legal basis for the prospectus

In principle, under the provisions of Regulation (EU) 2017/1129 and the German Stock Exchange Act (BörsG), a securities prospectus is required as part of a public offer or for the admission of securities to trading on an organised market. The legal exemptions from this obligation are specifically named and are an exception to the rule. The prospectus is an information and liability document. It has to include the legally standardised information required to enable investors to make an appropriate assessment of the issuer, the securities offered to them and, in particular, the associated risks.

The legal basis for the obligation to publish a prospectus for public offers is Article 3 for securities offered to the public in the European Union (Paragraph 1) or which are to be admitted to trading on an organised market in the EU (paragraph 3). Article 2(d) defines an offer to the public as a communication to the public in any form and by any means which contains sufficient information on the terms of the offer and the securities to be offered to enable an investor to decide whether to purchase or subscribe for those securities. The exemptions specified in Regulation (EU) 2017/1129 under which the obligation to publish a prospectus does not exist are of secondary importance in practice and for the classic IPO described here, but may become significant for future corporate actions.

Section 32 (3) of the German Stock Exchange Act (BörsG) refers to Regulation (EU) 2017/1129 for the admission of securities to trading on the Regulated Market and requires the submission of a prospectus approved or certified in accordance with the provisions of Regulation 2017 (EU) 2017/1129.

Approval of the prospectus

The competent authority for the approval of the prospectus is the Bundesanstalt für Finanzdienstleistungsaufsicht [BaFin, German Federal Agency for Financial Market Supervision].

Bundesanstalt für Finanzdienstleistungsaufsicht

Lurgiallee 12

D-60439 Frankfurt am Main

Telephone: +49 (0) 2 28-41 08-0

Fax: +49 (0) 2 28-41 08-15 50

Email: poststelle-ffm@bafin.de

The prospectus review process begins with the submission of an application for approval together with a draft of the prospectus to be approved and, if applicable, for notification to BaFin. The issuer has to submit the prospectus and accompanying documents to BaFin in accordance with Delegated Regulation (EU) 2019/980 in an electronic format via the MVP portal. It should be noted that registration on the MVP portal is required before a prospectus is submitted for the first time. The registration process takes time, so that the prospectus can usually only be submitted on the following working day. The same applies to supplements.

BaFin decides on the approval of the prospectus after completing a completeness check of the prospectus, including an examination of the coherence and comprehensibility of the information provided. Completeness is affirmed if the securities prospectus contains the minimum information required under Regulation (EU) 2017/1129 as well as other legally required components. BaFin does not carry out any further examination of the content, which means that an approved prospectus may still contain errors. This means that prospectus liability claims under Article 11 can be asserted even if the prospectus has been approved.

As required by law, BaFin must decide on the application for approval within ten working days of receipt of the prospectus, Article 20. The deadline is twenty working days if the public offer relates to securities of an issuer whose securities have not yet been admitted to trading on an organised market in a member state of the European Economic Area and the issuer has not previously offered securities to the public, i.e. in the case of an IPO. According to the wording of the provision, these periods begin after the draft prospectus has been submitted. The issuer then has the opportunity to make the necessary changes to the draft prospectus and resubmit the revised prospectus to BaFin for review via the MVP portal. As a rule, several hearings and revisions are required before the prospectus can be approved.

If there is any uncertainty as to what needs to be included in the prospectus, it is advisable to contact the approval authority at an early stage in the IPO process, even before the document is prepared.

Publication of the securities prospectus

After approval, Article 21 requires the issuer to publish the prospectus in good time before the public offer, and no later than at the beginning of the public offer. In the case of an initial public offering of a class of shares admitted to trading on a regulated market for the first time, the prospectus must be made available to the public at least six working days before the end of the offering.

The prospectus is deemed to have been published once the issuer has published it electronically on one of the following websites:

- Website of the issuer, the offeror or the person applying for admission to trading on a regulated market;

- Website of the financial intermediaries placing or selling the securities, including paying agents;

- Website of the regulated market on which admission to trading has been applied for or, if admission to trading on a regulated market has not been applied for, on the website of the operator of the MTF.

The prospectus must be published on the website in an easily accessible separate section. The file must be downloadable and printable and have a search function, but it must not be editable. Documents containing information incorporated by reference in the prospectus, supplements and/or final terms related to the prospectus and a separate copy of the summary will be made available in the same section as the prospectus itself, if necessary in the form of a hyperlink.

The publication of the prospectus is a prerequisite for the admissibility of the public offer. In addition, the publication of the prospectus is a prerequisite for the admission of the securities to the Regulated Market.

Contents of the securities prospectus

In order to meet the requirements of different types of securities, issuers, offers and authorisations, Regulation (EU) 2017/1129 distinguishes between different prospectus formats: a standard prospectus, a wholesale prospectus for non-equity securities, a base prospectus, a simplified prospectus for secondary issuances and an EU Growth prospectus. Different minimum disclosures are required depending on the prospectus format. Further details are set out in Delegated Regulation (EU) 2019/980. All prospectus formats must be written in an easily analysable and comprehensible form and contain all the necessary information about the issuer and the securities to enable the public to make an accurate assessment of the issuer's assets and liabilities, financial position, profits and losses, future prospects and the rights attaching to the securities. The wording must be chosen in such a way that the information about the issuer and the securities can be easily understood and analysed.

The structure of the prospectus may comprise one or three documents (Article 10 of Regulation (EU) 2017/1129). Irrespective of whether the prospectus has one or three parts, the following components have been specified:

- Summary of the prospectus,

- Description of the issuer (registration document) and

- Description of the security (securities note)

The contents of the components listed above are briefly explained below. Please note that the following presentation is only a rough guide and is not suitable as the sole basis for drawing up a prospectus. Details should be discussed with the competent BaFin department in case of uncertainty:

1. Summary of the prospectus

The prospectus summary is governed by Article 7 of Regulation (EU) 2017/1129. It should be precise, easy for investors to understand and limited to a maximum of seven A4 pages. The structure and content of the prospectus summary are clearly defined in order to ensure comparability across the EU. The summary is divided into four sections in accordance with Article 7(4): Introduction with warnings, basic information on the issuer, basic information on the securities and basic information on the public offer of securities and/or admission to trading on a regulated market. Detailed information and content on the individual sections are provided and defined in Article 7(5) et seq. The key information about the issuer section includes, for example, the registered office, legal form of the issuer, its LEI, principal activities and shareholders of the issuer as well as specific financial information. In addition to the general information, risk factors must also be shown in subsections, which must not exceed a length of 15 A4 pages.

2. Description of the issuer (registration document)

The second part of the prospectus comprises the description of the issuer, which reflects the registration document if the prospectus has three parts. This paragraph describes the company's organisation, business activities, financial position, earnings and future prospects, management and shareholding structure. The requirement for specific content and the structure may vary depending on the circumstances. The Annexes to Delegated Regulation (EU) 2019/980 must therefore be taken into account in this context.

3. Description of the security (securities note)

The third component contains information on the securities that are to be offered to the public or admitted to trading on a regulated market. As with the description of the issuer (registration document), Delegated Regulation (EU) 2019/980 differentiates between various securities descriptions, which are specified in the annexes depending on the circumstances.

Significance of the prospectus for admission to trading

In principle, the publication of an approved securities prospectus is a prerequisite for the admission of securities to the Regulated Market. This means that approval and publication of the prospectus must always precede the admission decision. The prospectus must be attached to the application for admission of securities to the Regulated Market, stating the publication method and BaFin's notice of approval.

The legal basis for this can be found in Section 32 (3) BörsG, which refers to Regulation (EU) 2017/1129 for the admission of securities to trading on a regulated market and requires the submission of an approved and published prospectus.

Prospectus liability

While Regulation (EU) 2017/1129 largely harmonises prospectus law across the EU, the liability regime continues to be regulated at national level. Prospectus liability in Germany is mainly governed by Sections 9 et seq. WpPG and is subject to the following requirements:

Grounds for a liability claim are the acquisition of securities admitted to trading on the stock exchange on the basis of an incorrect or incomplete prospectus.

Liability is always limited to those securities acquired on the basis of the prospectus that were, for example, authorised as part of the initial issue. Those who have assumed responsibility for the prospectus and those who have issued the prospectus are named as joint and several debtors.

The contractual acquisition transaction must have been concluded within six months of publication of the prospectus and after the initial introduction of the securities; it is irrelevant here whether this is the initial acquisition or a subsequent acquisition.

The purchaser is entitled to reimbursement of the purchase price plus the usual costs associated with the purchase in return for the retransfer of the securities, Section 9 (1) WpPG. If the purchaser is no longer the holder of the securities, he or she may demand the difference between the purchase price and the sale price, including the usual costs associated with the securities transactions. In both cases, the purchase price is limited by the first issue price of the securities, Section 9 (2) WpPG.

With regard to the attributes "incorrect" and "incomplete", it should be noted that the "incomplete" attribute is a subset of "incorrect", meaning that an incomplete prospectus is always incorrect. The prospectus is incomplete if material or required information is not included in the prospectus. The inclusion of all the information required by Regulation (EU) 2017/1129 does not mean that the prospectus is complete. Rather, these requirements come close to being met if the prospectus enables the public to make an accurate judgement about the issuer and the securities, among other things.

There is no prospectus liability under the German Stock Exchange Act, unless the prospectus is incorrect or incomplete due to intent or gross negligence and was therefore not known, or the lack of knowledge is due to a particularly serious breach of due diligence, Section 12 (1) WpPG. This is where the responsible listing partners play an important role, as they help to build a "legal defence" by preparing the prospectus, issuing legal and disclosure opinions from legal advisors and comfort letters from the auditors and in some cases contribute to the release from liability. In all cases, the co-applicant for admission of the securities to the Regulated Market, who is usually one of the listing partners, is also liable under the prospectus liability of the Stock Exchange Act.

It should be noted that the approval of the prospectus by BaFin does not indicate that the prospectus is correct and complete. In addition to the prospectus liability under the Stock Exchange Act outlined above, there is also a prospectus liability under the German Capital Investment Act, under investment law and under civil law; they will not be discussed here.

Helpful information for securities issuers

Where are securities prospectuses available?

The prospectus must be published in accordance with Article 21 of Regulation (EU) 2017/1129. It is usually made available electronically on the issuer's website. BaFin also maintains a database ("Filed securities prospectuses"), from which securities prospectuses can be downloaded.

How long is a securities prospectus valid?

In accordance with Article 12 of Regulation (EU) 2017/1129, a prospectus is valid for twelve months from approval for public offers or admissions to trading on a regulated market, provided that it is updated with any necessary supplements (Article 23 of Regulation (EU) 2017/1129). In summary, the supplement serves to update, but possibly also to correct the prospectus by presenting "any significant new factors" or correcting "any material inaccuracy". In light of the prospectus liability, the need to draft supplements should be carefully examined.

Essential information for issuers

Information on the legal basis, components, language and other points relating to the securities prospectus can also be found on the BaFin website.

Contact Person

BaFin Bundesanstalt für Finanzdienstleistungsaufsicht,Referat PRO1

Telephone: +49-(0) 228-41 08-0

Related links

- Börsengesetz [German Stock Exchange Act]

- Börsenzulassungs-Verordnung [German Stock Exchange Admission Regulation]

- Prospektverordnung EG Nr. 809/2004 [Prospectus Resolution (EC) No. 809/2004]

- Prospekt-Richtlinie [EU-Directive on Prospectuses]

- Bundesanstalt für Finanzdienstleistungsaufsicht [German Federal Agency for Financial Market Supervision]

- Wertpapierprospektgesetz [German Securities Prospectus Act]

Placement

Briefly, you have to do the following:

- Preparation of an offer for sale

- Offering price determination

- Stock placement

- Allocation of stock to investors

General

A placement within the scope of an IPO (“Initial Public Offering“) means the execution of a first-time public offer for sale of securities on the capital market. Therefore, the placement is among the most important functions of the syndicate bank and is critical for going public successfully.

In the process it is the company’s objective to sell the complete amount of stock to be placed at a price attractive to both company and investors.

Prior to actual placement proceedings, an agreement on the takeover of the new securities for sales purposes (= takeover agreement) is concluded between the company and the banking syndicate, which is followed by the offering procedure. At the end of placement proceedings, the securities offered will be allocated to the future investors.

If the placement is not public, it is a private placement. In case of a private placement the stock to be placed is offered for sale exclusively to a limited circle of investors and usually the offering will not be communicated through public media.

The Public Offering

For an IPO the stock is advertised in public and the company is presented, among other means in the course of road-shows, to the institutional investors. In order to provide investors with the information required for their investment decision, the company publishes a securities prospectus which has to be reviewed and approved of in advance by the Bundesanstalt für Finanzdienstleistungsaufsicht [BaFin, German Federal Agency for Financial Market Supervision].

The public offer for subscription and sale is directed both to the institutional investors and to the public (above all, to private investors); besides better sales potential, the public offer benefits from the fact that it will address a wide-spread investing public and will attract corresponding attention.

Thus, a sufficient free float of the securities is achieved, which is not only a requirement for the securities’ admittance for stock exchange trading on the Regulated Market, but also for well-functioning stock trading in general.

Determination of the Offering Price

Price determination is among the most important steps in the course of a securities issue as the price will decide on the proceeds and, thus, on the success of the issue. The offering price can be determined as a fixed price prior to starting the offering (so-called fixed price procedure) or the price can be established openly during the offering procedure based upon the principle of supply and demand (tender procedure and book building procedure).

The determination of the offering price is based on a thorough analysis and evaluation of the company (due diligence) which has been performed in preparation of the price determination under consideration of the stock market valuation of similar companies (peer group) as well as the general market situation. Based upon the market price for shares in the company calculated in the aforementioned way (“fair value“), the price or a price range for the stock is determined. On the one hand, the sales price shall meet the company’s financial requirements, but shall also contain, on the other hand, potential for price increases in order to let investments in this security appear as an attractive option to possible investors.

Depending on their focus during the issue, the company will select one of the following methods for the offering price determination:

- fixed price procedure

- tender procedure

- book building procedure

When the fixed price procedure is chosen, the stock is placed at a fixed price, i. e. prior to the offering’s start, the company and the syndicate members will fix a sales price which forms the base for the public offering and will be communicated to the market in the course of publishing the offer conditions. This method of price determination bears the disadvantage that company and syndicate members will not be in the position to react to a changing market environment in the course of the offering. If the price is considered too high by market participants, there is an increasing risk that either not all of the securities might be placed or the price might need downwards adjustment, which would result in the issue revenue falling behind expectations and the success of the issue being jeopardized.

For placing a securities issue through the so-called tender or auction procedure, there will be no decisive sales price determined. The offering merely contains details regarding the security’s features, the issue volume and a minimum price as lower limit. During the subscription period, interested investors may enter a purchase bid at minimum price or above. At the end of the offer period the buyers will purchase a security, depending on prior determination, either at a standard price calculated for instance as the arithmetic mean of all bids submitted (so-called “Dutch procedure“) or at the purchase price as set forth in their individually submitted bid (so-called “American procedure”). This price determination method will determine the price according to the principle of supply and demand. The issue revenue and, therefore, also the success of the public offering will depend upon the market at the end of the day. As a consequence, investors need sufficient knowledge of the capital market and the current market situation in order to submit an adequate bid for the securities at sale when this price determination method is applied.

Finally, the book building procedure combines the advantages of the fixed price procedure with those of the auction procedure. During this past years, it has developed to become the most favoured price determination instrument especially for stock issue and, thus, will be explained in more detail below.

The book building procedure is divided into different stages:

For the classic book building procedure company and banking syndicate will jointly agree on a price spread prior to the start of the offer period. This spread will be ascertained in advance by the syndicate members based upon the due diligence performed in combination with a targeted investors’ survey. In the course of such survey, the banks inquire the interest of potential investors in the stock by asking, for instance, for non-binding purchase bids. Prior to the start of the actual offering stage, a price spread will be determined and published accompanied by any other Information regarding the securities offered.

At the same time as the discussions with investors for the price spread determination take place, the company will present itself accompanied by the banking syndicate at various finance venues to give interested investors an opportunity to collect in systematic manner information regarding the securities and the company. These so-called “road shows” aim at winning over potential investors by means of professional marketing, individual contact to certain investor groups and providing of transparency.

Upon start of the subscription period, all bids received within the allowed price spread are entered into a central order book. After the period’s expiration the offering price is determined according to the existing bids (closing). Purchase bids below this offering price will not be considered in the process of stock allocation. Investors offering a price higher than the final offering price will purchase the security at offering price. In case the number of purchase bids should exceed the number of stock to be issued by the company, allocation criteria will be determined. Thus, this kind of price determination leaves the company with the option to take influence on the kind and spreading of their future shareholders in the course of deciding on the sales price.

As a variation of the classic book building procedure, the so-called “decoupled book building” has developed. For this method the subscription period is shortened to a few days and the price spread is published only a short while prior to opening the order book. At this moment, the road show usually has been finished. Therefore, the marketing of the securities is decoupled from the determination of the price spread and offering price. In doing so, the risk that the issuing price might be getting under pressure e.g. from public opinion is limited to the stage of the shortened subscription period.

The Allocation

The submission of a purchase bid or an order for subscription of securities does not create a title to purchase such securities at all or at a certain price. Such title requires an allocation. In the course of the allocation the company and the syndicate manager decide if and how many stock an investor shall receive based on the bid they submitted. For this allocation decision the intended shareholder structure will be the central criterion. Here thoughts might be considered, if, for instance, a broader spreading of stock should be aimed for, if more private investors or institutional investors are wanted as shareholders or if international shareholding is desirable.

In case of oversubscription of securities, when the number of purchase bids exceeds the number of stock actually issued by the issuer, the company and the syndicate manager will set forth allocation criteria according to which the stock will be assigned. The investors may receive only a part of the requested securities based upon a calculated quota resulting from the allocation criteria.

Some companies use the option to reserve part of the securities offered to the public for employees of their company or of affiliated or partner companies of the issuer and to allocate stock preferably to these investor groups in the scope of “friends and family”- programs.

Generally the allocation takes place already in the evening of the last day of the placement period directly following the closing and is published through electronic media on the same day. Securities launched for public subscription can be introduced into stock exchange trading only after the allocation has ended.

The Placement Risk

In order to transfer the placement risk, depending on the company’s interests and willingness to assume risks partially, or wholly to the banking syndicate, the company and the issuing syndicate, as a rule, will conclude a takeover agreement prior to the start of the public offering. There are various options for risk distribution.

If the parties choose the form of an underwriting syndicate, the syndicate banks will purchase the intended number of issued stock (syndicate share) at a fixed price in order to sell it afterwards on the capital market in their own name. The placement risk (sales and price risk) lies with the banks. Remainder of stock not placed at the end of the offering and allocation proceedings will remain for the time being in proprietary possession of the syndicate members.

In the converse case, the banks will function as mere selling group. The banks act as commission agents for the initial placement of the securities. They may provide the company, if need be, with a standing of the underwriter for pre-financing the securities launch and place the securities on behalf and in the name of the company. In this case the complete placement risk regarding the price for the securities offered as well as the number of sold stock lies with the issuer.

In practical use, a combination of both variations has developed, the underwriting and selling group. This form combines the takeover of securities by the syndicate banks with the intention of leaving the performance and placement risk in adequate extent with the candidates for flotation. This may be achieved, for example, by setting the time for purchase or takeover to a date near the end of the subscription period or by determining the purchase or takeover price to the legal minimum amount. With an underwriting and selling group, there are options for the company to make arrangements regarding the decision on the eventual size of the capital increase and the determination of the launch time. In this connection “greenshoe options” or opt-out clauses agreed upon for certain circumstances may also serve the purpose of equal risk distribution.

The Private Placement

At a private placement the newly created stock of a company is not offered to the public, but exclusively to a selected circle of investors. The banks and the company jointly will systematically approach potential investors whom they are in permanent intensive contact with. As a rule, these will be institutional investors or major investors.

This form of placement is an option, for example, for smaller domestic issues. Above all, the advantage lies in the fact that pursuant to the provisions of the Regulation (EU) 2017/1129 the company will be relieved from the obligation to draw-up and publish a securities prospectus for an offering which is directed to less than 100 investors in each state of the European Economic Area. This will save both costs and time.

The introduction at the stock exchange will also be possible in the course of a private placement, if all other requirements for admitting the stock to trading, especially the requirements regarding the stock in free float, have been met and an approved securities prospectus has been published. In this connection, a private placement may also be considered as supplement to a domestic public placement. This may grant the option to sell part of the securities internationally without having to bear with the international regulations for offerings, like the respective prospectus publishing requirements.

Contact Person

Issuer Hotline

Telephone: +49-(0) 69-2 11-1 88 88

Fax: +49-(0) 69-2 11-1 43 33

Related links

Custody

Briefly, you have to do the following:

- Prepare a legally valid securities certificate

- Cause the certificate’s depositing at the securities clearing and deposit bank

- Name a principal paying agent

General

The admission of a company’s stock to trading at the Regulated Market is subject to the free tradability of such stock, see Sect. 5 Börsenzulassungs-Verordnung [BörsZulV, German Stock Exchange Admission Regulation]. Pursuant to EU-law (Art. 35 Verordnung 1287/2006) [Commission Regulation (EC) No. 1287/2006] free tradability requires that securities may be traded and afterwards transferred between the parties of a transaction and that all securities are fungible within the same class. In order to provide for the required transferability, the stock has to be certificated and deposited in form of a document at a central depository, a securities clearing and deposit bank. A securities clearing and deposit bank is a credit institution which assumes the central depositing of securities and which was recognized for this task by the competent official body, see Sect. 1 Depotgesetz [DepotG, German Securities Deposit Act]. At the moment, there is only one officially recognized securities clearing and deposit bank in Germany which is the Clearstream Banking AG, Frankfurt am Main (“Clearstream“). The inclusion of stock of German companies in the Open Market at Frankfurt Stock Exchange also requires depositing a securities certificate with the CBF.

There are various options for the certification of securities as well as for their depositing. In the scope of an IPO, the issuing house will usually submit the stock in form of a permanent global certificate for the issuer at Clearstream for collective custody. Please learn below what exactly this procedure means and how it works:

Certification of Securities

Securities may be certificated as separate or global certificates. According to the security’s historic concept the buyer obtains a certificate embodying the issuer’s undertaking to pay or the membership right, respectively, which the holder may take home to keep it safe at their own place. This case refers to a so-called separate certificate bearing a certain value whose sole owner and holder is the buyer of the right.

The separate securities certificates (= physical securities) consist of a corpus, which is the master document embodying the ownership right in the company, of a coupon sheet with up to 20 coupons and a renewal coupon. The coupon sheet is the so-called ancillary document and the individual coupons have to be submitted to the competent paying agents in order to claim rights deriving from the document, e.g. subscription rights for newly issued stock. This requires presentation of the coupon sheet as evidence for ownership; the corpus, however, does not need to be presented. After all coupons have been used up, the renewal coupon may be turned in at a paying agent to request a new coupon sheet. This procedure also does not require the presentation of the master document. The renewal coupon in itself is the title-evidencing instrument for the shareholder.

The (principal) paying agent of the company is a bank or credit institution responsible and specifically authorized by the company for the settlement of any corporate actions connected to the securities (like e.g. dividend payments). Often the issuing house or one of the underwriting syndicate banks will assume this function. The investor may learn the institution assuming the function as payment agent from the securities prospectus, for instance.

For separate certificates of stock to be admitted for stock exchange trading, there are precise requirements regarding their format, composition, layout and print mode. These are determined in the “Gemeinsame Grundsätze der deutschen Wertpapierbörsen für den Druck von Wertpapieren” [Mutual Principles of Stock Exchanges in Germany for the Printing of Securities]. According to regulations of stock corporation law, the certificate has to be signed by the issuer, see Sect. 13 Aktiengesetz [AktG, German Companies Act].

As the certification of securities rights as separate certificates nowadays, in view of the circulation of securities, would result in enormous costs for material and transfer and cause major delays in the assignment of documents, the issuance of securities in form of a global certificate has become the normal case.

Pursuant to Sect. 9a DepotG a global certificate is an individual security in central custody certificating a complete issue or parts of it. There are three different kinds of global certificates: the global bond certificate, the temporary or interim global certificate and the permanent global certificate.

Normally, only part of an issue will be issued as global bond certificates. In addition, separate certificates exist in order to fulfil possible shareholders’ claims to delivery. This form of certification saves the company costs because there is no need to have separate certificates printed for each company share; it also saves space and effort for the depositing credit institutions in custody and management of these securities.

The form of a temporary global certificate often is selected at the beginning of a stock offering. The global certificate is deposited at a securities clearing and deposit bank in order to bridge the time to the existence of a permanent global certificate and, thus, to obtain the admission to stock exchange trading as soon as possible. After closing the IPO (“Initial Public Offering“) this interim certificate will be exchanged for a permanent global certificate.

The characteristic of these two global certificates is the fact that the right to claim a separate certificate stays with the shareholder; as a consequence, companies have to provide separate certificates upon request, see Sect. 9a Paragraph 3 Clause 1 DepotG. Pursuant to Sect. 10 Paragraph 5 AktG the claim of the shareholder for separate certificates may be excluded in the company’s articles of association. In this case, the securities will be issued as permanent global certificates.

This kind of global certificate certificates a complete issue or even any and all stock issued by a company, potentially for the whole duration of the securities. The shareholder’s right to demand physical separate certificates is excluded.

Securities Custody

In practice, stock certificates usually are left at banks conducting securities accounts or at a securities clearing and deposit bank to be held in custody, which allows for a non-physical transfer of securities. The Depotgesetz contains specific details regarding the persons authorized to keep securities in safe custody for others, the various custody options and the detailed organization of custody. Securities certificates may be held in different forms of safe custody.

German law on safe custody knows three legally different kinds of custody:

- the segregated or jacket custody,

- the collective custody and

- the credit for safekeeping of securities abroad.

Securities listed at a stock exchange are usually kept in collective custody at a securities clearing and deposit bank.

In segregated custody the separate certificates are deposited at a bank or an institution conducting securities accounts in such a manner that pursuant to Sect. 2 DepotG a separation from the custodian’s own holdings and third-party holdings is externally visible, e. g. by means of so-called jacket custody. This kind of custody safeguards that the securities account holder (= depositor), at the time the certificates are taken from safe custody, will be returned exactly the same physical certificates that had been deposited by them. Due to the separation, the depositor’s sole ownership in the respective physical securities certificate remains unaffected.

The jacket custody owes its name to the individually marked paper ties which serve the purpose of distinguishing the individual certificates and separating them from the holdings of other shareholders in safe custody. In earlier times, the jacket contained the holder’s name and account number, the securities class, securities amount and securities number as particulars for individualizing the certificates. Today the certificate numbers of the securities deposited for jacket custody are registered and the certificates are kept separated from other certificates of the same class.

A variation of the segregated custody is the third-party custody ship; in this case the institution conducting securities accounts functions as intermediate custodian and transfers the holdings in its own name to a third-party custodian, e. g. the Clearstream, to be kept there in safe custody, see Sect. 3 DepotG.

There is also the option of collective custody. The securities deposited are no longer kept separate for each depositor, but are combined to a uniform holding insofar as they belong to the same class. Instead of sole ownership of a separate certificate, the shareholders own in co-ownership an imaginary fraction of the total holdings which is credited to a securities account, see Sects. 5 et seq. DepotG. This allows for a quick and efficient non-physical securities transfer (= giro collective custody), for the transfer of rights in or from the securities is performed solely by means of entering money to accounts (so-called securities clearing transactions).

In these collective holdings, the shareholders (= depositors) hold co-ownership at a fraction corresponding to the number of securities deposited by them. The ownership is legally valid towards anybody and for the assignment of securities in collective custody the general civil law principles apply, i. e. seller and recipient have to agree on the transfer of right and a transfer action (= securities account entry) is required. If the depositor may claim for the delivery of separate certificates and makes use of such claim they will be provided with stock corresponding in kind and nature to the stock handed in by the depositor to the collective holding.

If the company decides to issue its stock as a permanent global certificate, such certificate has to be kept for custody pursuant to Sect. 9a Paragraph 1 DepotG at a securities clearing and deposit bank, unless the issuer demands separate custody. As central custodian in Germany, Clearstream assumes part of the custodian banks’ functions. The benefit lies in the fact that securities transactions involving various custodian banks may be settled centrally through the securities clearing and deposit bank and do not require numerous technical connections among the various custodian banks. Thus, the central collective custody serves the purpose of facilitating custodial services and saving costs in the course of securities custody and management. Therefore it is the kind of custody which is generally selected by publicly quoted companies.

The custodian banks as clients of CBF and as intermediate custodians and CBF as securities clearing and deposit bank function as bailors for the depositor, thus by means of constructive possession of chattels based on agreement [Besitzmittlungsverhältnis] legally arranging for the depositor’s possession of the securities in custody. As custodians they do not own the stock. Within the assignment of securities co-ownership shares, the constructive possession of chattels based on agreement is shifted with each securities purchase or sale on every custody level from the selling to the acquiring depositor or their respective custodian banks. For securities deposited at CBF by a custodian bank in its function as intermediate custodian the non-property presumption pursuant to Sect. 4 Paragraph 1 DepotG, applies, i. e. the custodian bank, as a rule, is not deemed the owner of the securities it deposited.

The custody and settlement in securities rights (WR), the so-called fiduciary book entry transfers, has been provided for only rudimental in the German Securities Deposit Act. It is a special kind of securities custody which is employed, for instance, when foreign securities are purchased. If the client instructs the bank to acquire foreign securities, the bank will procure these securities as commission agent abroad. In doing so the bank, according to their dutiful discretion with adequate regard to the client’s interests, will obtain the securities’ ownership or co-ownership or another, similar legally valid position commonly accepted in the state the stock is kept safe and will hold this legal position in fiduciary manner for the client. The investor will receive a credit for safekeeping of securities abroad (= WR-credit) stating the foreign state where the securities are kept safe. Towards the custodian bank acting as fiduciary for them, the client merely possesses a contractual claim to restitution regarding this legal position as well as authority to give directives resulting from the fiduciary relationship. The domestic transfer of this legal position is performed according to law of obligations principles by debiting and crediting of accounts.

Admission for Collective Custody

Certificates to be kept in custody by CBF have to undergo a special admission procedure in view of their ability to be kept in collective custody.

An underwriting bank who maintains an account at Clearstream will submit at CBF the securities certificate, which has been signed in legally valid manner by the company, alongside with an application for admission to collective custody and additional documents. The signatures of the persons signing the admission application have to be deposited at CBF to allow a review of the authorization of the persons acting for the issuing house. Pursuant to A) Chapter II Paragraph 1 of the Allgemeinen Geschäftsbedingungen der Clearstream [General Terms and Conditions of Clearstream] any legal entity that CBF enters into a business relationship with may be a client.

Generally these will be:

- credit institutions operating custody activities,

- brokerage houses either operating third-party or their own stock exchange transactions,

- securities clearing and deposit banks from abroad,

- foreign institutions settling securities transactions, e. g. Clearstream Banking S.A., Luxemburg and

- securities trading houses from abroad.

The application letter has to be directed to

Clearstream Banking AG

Schalterhalle

Neue Börsenstraße 8

D-60487 Frankfurt am Main/Hausen

and has to contain the iSIN, dividend entitlement as well as the competent paying agent. If the function of paying agent is not assumed by the applicant themselves, another bank exercising this function has to be named. A paying agent who is not the applicant also has to maintain an account at CBF and has to confirm in writing that they assumed the paying agent function. Moreover, the application has to contain the confirmation of the legal validity of the signatures borne by the submitted global certificates, i. e. the submitting issuing house has to declare in legally binding manner that the certificate has been signed by members of the issuer authorized to give such signature. The securities certificate and the application for admission to collective custody have to be accompanied by the company’s legally valid, current articles of association as well as a certified, up-to-date excerpt from the commercial register to give evidence of the actually paid-in stock capital.

CBF reviews the submitted securities with regard to their authenticity, completeness, deliverability and their further ability for being kept safe in collective custody. Above all, at the submission of physical securities, Clearstream will check the following:

|

In addition, CBF will check upon deposit of securities with the help of the announcements contained in the Bundesanzeiger [German Federal Gazette] if there are any notices of loss, payment stops or public notification procedures (procedure for invalidation of certificates) with regard to these securities.

When securities are admitted for collective custody. CBF will publish the admission via the WSS Wertpapier Service System [WSS Securities Service System] (WSS online) which can be accessed by the underwriting banks as registered members. WSS is an electronic information system of Deutsche Börse AG providing its registered members with all information relevant for securities settlement. The data provided include within a single online-application master data as well as maturity data and quotation data generated, among others, from trading data at Frankfurt Stock Exchange and the WM-data. Subsequently, the stock is entered by CBF according to its value into the account of the applying issuing house through the stock exchange-owned settlement system CASCADE (abbreviation for Central Application for Settlement, Clearing And Depository Expansion). The issuing house, on the other hand, distributes the book entry securities of the stock to the shareholders through their custodian banks. The securities certificate itself is deposited and kept inside the about 6000 sq.m. large vault of CBF until the certificate will be replaced or the stock certificated in it is no longer existent.

The legal framework for the admission of securities for collective custody have been set forth in the Allgemeinen Geschäftsbedingungen der Clearstream Banking AG, [General Terms and Conditions of Clearstream Banking AG] Frankfurt am Main.

In case of questions please contact the “General Customer Support“ of CBF

under telephone number+49-(0) 69-2 11-1 11 77

or via telefax message under number +49-(0) 69-2 11-61 11 77

or via email under csdomestic@clearstream.com.

Contact Person

General Customer Support

E-Mail: csdomestic@clearstream.com

Telephone: +49-(0) 69-2 11-1 11 77