Listing process Regulated Market

Listing process Regulated Market Prime Standard

Overview

Selection of IPO-experts / IPO-conception

Briefly, you have to do the following:

Select the IPO-experts who usually consist of

- an IPO-advisor,

- an issuing bank and a banking syndicate,

- certified accountants and lawyers as well as

- a PR-agency.

At the beginning of the IPO-process you work out an IPO-conception jointly with the IPO-counsel and/or the issuing bank, which serves as schedule leading to the ultimate object “IPO“.

General

An initial public offering (IPO) is a complex process requiring both practical as well as special technical knowledge. It is divided into a preparation stage, a planning stage and an actual process stage. On its way to going public, the company needs qualified partners during the different processes that render assistance in various ways. Therefore, for its IPO the company will seek the assistance of a team consisting of IPO-advisor, an issuing bank and further syndicate banks, certified accountants and lawyers as well as a PR-agency, if need be. In cooperation with part of their IPO-underwriters the company will prepare a project plan covering the complete IPO-performance, which determinates and structures its contents and arranges the time schedule. This IPO-conception forms the base for the cooperation of all persons involved in the project.

IPO-experts

Due to the complexity of an IPO, counselling in various areas performed by experts from different functional directions is required. As a rule, these are:

IPO-advisor

Often the IPO-advisor is the first contact point for the company planning to go public. Depending on the agreement concluded with the company, the IPO-advisor’s activities may be limited to a kick-off counselling or may cover the complete process. The IPO-counsel’s position is that of an independent counsel. In this function, the IPO-advisor might be in conflict with the issuing bank, for one, due to a possible interference of their areas of activity and, for another, due to the fact that the IPO-advisor is under no obligation towards the cooperating banks and can position the company in relation to the syndicate banks. In many cases it will be the IPO-advisor who takes over the management for the preparations along the way to going public and who assumes project management and coordination.

Above all, the possible fields of activity of an IPO-advisor are the following:

- review if the company meets the requirements for going public,

- review of the company strategy, the corporate planning and the management processes,

- assistance with compiling the company’s equity story displaying key skills, success factors and perspectives of the company,

- preparation of a fact book as well as a management presentation,

- preparation and assistance of the company in selecting the underwriting banks or other capital market experts (so-called “beauty contest“),

- project management and coordination of the cooperation between all the IPO-underwriters and the company and

- development of a first IPO-conception with benchmarks of the IPO-plans.

In addition, the IPO-advisor may support the company, if need be, even after the IPO in the course of public and investor relations activities.

Issuing bank and banking syndicate

Generally an IPO will be accompanied by a banking syndicate, i. e a consortium of several banks and/or financial services providers with one of the banks assuming the function of the syndicate manager. The leading issuing bank as well as the other underwriting syndicate members often are selected by means of a so-called “beauty contest“. The company provides several banks of its choice with information on the company, for instance in form of a fact book and a description of the company’s personal equity story, and invites the banks to apply for syndicate membership or for the syndicate manager position for the IPO in question. The banks and financial services providers will use the information on the company to gain a first evaluation of the possible success of an IPO with this company.

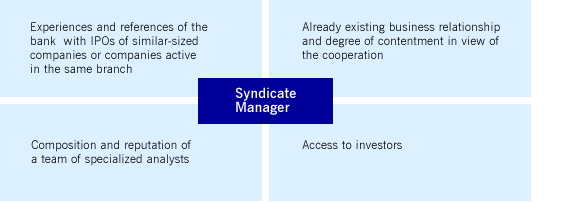

The company’s decision for a certain candidate as syndicate manager is of great importance and gives direction to the further success of the IPO. Therefore, the size of the institute should not bet he only criterion, but the company should consider in its selection also other matters which are listed in exemplary manner here.

In practice, the selection of the leading issuing bank and the composition of the banking syndicate will be directed to the objective of addressing a preferably wide-spread investor circle and to achieve an optimal offering price for the company’s stock.

The core functions of the issuing bank belong to the actual process stage. During this stage the responsibility of the syndicate manager reaches from the preparation of a detailed time schedule covering the complete IPO-process and the care for adherence to this schedule, to the performance of a thorough evaluation of the company (due diligence), to the company’s positioning on the capital market by means of the equity story up to the successful marketing and placement of the stock offered. Simultaneously, the issuing bank is involved in the preparation of the securities prospectus and leads the company through the subsequent stock market listing process from application submittal to the first price fixing.

In short, the syndicate manager’s functions, above all, are the following:

- review if the company meets the requirements for going public

- performance of due diligence and company evaluation

- preparation of a thorough IPO-conception including a detailed time schedule

- preparation of research and analysts’ presentations

- cooperation in the preparation of the securities prospectus

- marketing and placement of the IPO

- assistance during the complete process of admitting the securities for listing

- support of the issuer after the IPO.

For performing all of its functions the issuing bank relies on the company’s close and trusting cooperation.

Legal counselling

Lawyers may be involved at various times in the IPO-process. During preparation stage, the company might need to undergo restructuring measures under company law in order to meet the requirements for going public. In such a case, the supporting lawyers will assist the company, for example, with changing its legal form of organization to a joint-stock company or with modifications of its existing articles of association.

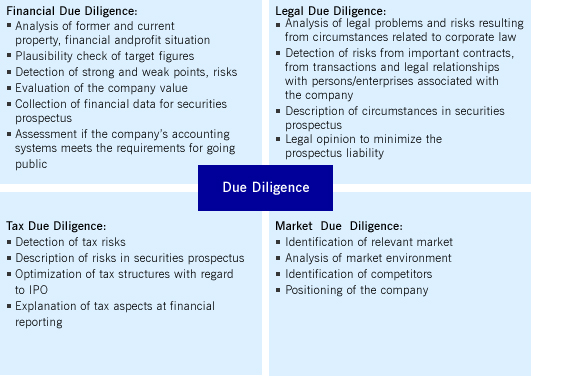

During the actual process stage, the preparation and performance of a legal due diligence is among the lawyers’ core tasks in the course of an IPO. The legal due diligence serves the purpose of checking the complete legal circumstances of the company and to discover and evaluate, as thoroughly as possible, any and all legal risks resulting from the issuer’s legal and business relationships. In this context, pending legal disputes will also be reviewed.

Finally, experienced lawyers will generally be involved in the preparation of the securities prospectus. Thus the company can safeguard that the contents of the prospectus will comply with all requirements set forth in the Regulation (EU) 2017/1129. After preparation of the prospectus, the lawyers will also assist the company during the approval procedure at the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) [German Federal Agency for Financial Market Supervision] and support the company at implementing the necessary prospectus supplements and corrections. After performing the due diligence and preparing the prospectus, the lawyers, if need be, will confirm to the syndicate manager or other parties involved in the process by means of a legal opinion, that the prospectus correctly and completely displays the legally relevant topics.

Certified accountant

Depending on the trading segment and transparency standard aspired, there are different requirements regarding the accounting standard of the candidate for flotation. Therefore, it might be necessary to involve the certified accountant into the IPO-process at an early stage already. In case of a public offering of securities the accountant will assist the company, for instance, already during the planning and preparation stage with the conversion form national accounting to IFRS-accounting required for Annual Consolidated Report or with reorganization measures performed by the company in advance, insofar as the preparation of financial information is necessary.

Further on, the certified accountant performs a thorough financial due diligence, in the course of which the company’s economic development so far as well as the economic development it intends to take in the future come under critical review. This review and the definition of chances and risks are entered in form of secured financial information and risk notices into the securities prospectus. Depending on the trading segment selected and the related transparency standard, the IPO requires the financial statements of preceding business years to be reviewed and provided with the auditor’s certificate and included in the securities prospectus.

Moreover, the certified accountant confirms, by means of a comfort letter towards the issuing bank the financial figures and financial statements contained in the prospectus. This comfort letter also serves as documentation of the individual review services performed by the accountant.

PR-agency

The public relations counsel (PR-counsel) manages in close collaboration with the candidate for floatation and the syndicate manager the communication processes with the important external target groups as well as the business and financial press media . An IPO centres the company into the focus of the capital market. As a result extensive requirements regarding the communication with investors, analysts and other participants of the capital market have to be met. The communication activities aim to increase the company’s awareness level on the capital market, to present the business activities into the context of market and competition and to position convincing arguments for a share investment. In doing so, the PR-counsel, in coordination with the company and the issuing bank, assumes the following functions:

- development of a communication strategy,

- participation in the development of an Equity Story

- preparation of a presentation for the road show,

- assistance of the company in press releases and ad hoc disclosures regarding the IPO,

- individual preparation of the management for appointments with media and investors,

- organization of an IPO-press conference,

- conception and implementation of a company’s investor relation-website,

- preparation of the company regarding an obligatory communication and the investor relationship work after floatation.

The PR-counsels offer also further services. For instance, they often support the company in the active media relations work as well as the coordination of management interviews with journalists, up to the complete organization of IPO marketing campaigns. Some PR-counsels offer the company’s public or investor relations services after the IPO has been concluded.

Deutsche Börse Capital Market Partner

For selecting the adequate IPO-underwriters, Deutsche Börse AG offers a network of experienced capital market experts, who can be recognized as Deutsche Börse Capital Market Partner. On the websites of Deutsche Börse AG you will find an up-to-date list of all Deutsche Börse Capital Market Partner, that are active in connection with admissions to the Regulated Market.

IPO-conception

Contact Person

Issuer-Hotline

E-Mail: issuerservices@deutsche-boerse.com

Telefon: +49-(0) 69-2 11-1 88 88

Fax: +49-(0) 69-2 11-1 43 33