Special Purpose Acquisition Companies (SPAC)

Special Purpose Acquisition Companies (SPAC)

An alternative to the traditional IPO (Initial Public Offering) is the option of listing a Special Purpose Acquisition Company (SPAC) on the stock exchange. A SPAC is a shell company with no own business operations. Its sole objective is to raise capital through a listing, the proceeds of which are subsequently used to acquire a non-listed company within a limited period of time and to indirectly list it on the stock exchange. While the company to be taken over is not yet determined at the time of the SPAC listing, the industry of the acquisition target often is known at this point. SPACs are particularly suitable for well-established companies with sound growth potential seeking a safe, timesaving and cost-effective alternative to a traditional IPO.

At Deutsche Börse, SPACs can be listed on the Regulated Market of Frankfurter Wertpapierbörse (FWB®, the Frankfurt Stock Exchange; General Standard and Prime Standard).

SPACs already listed at FWB® can be found here.

Main features and particularities

1. Investors receive SPAC shares of stocks and warrants

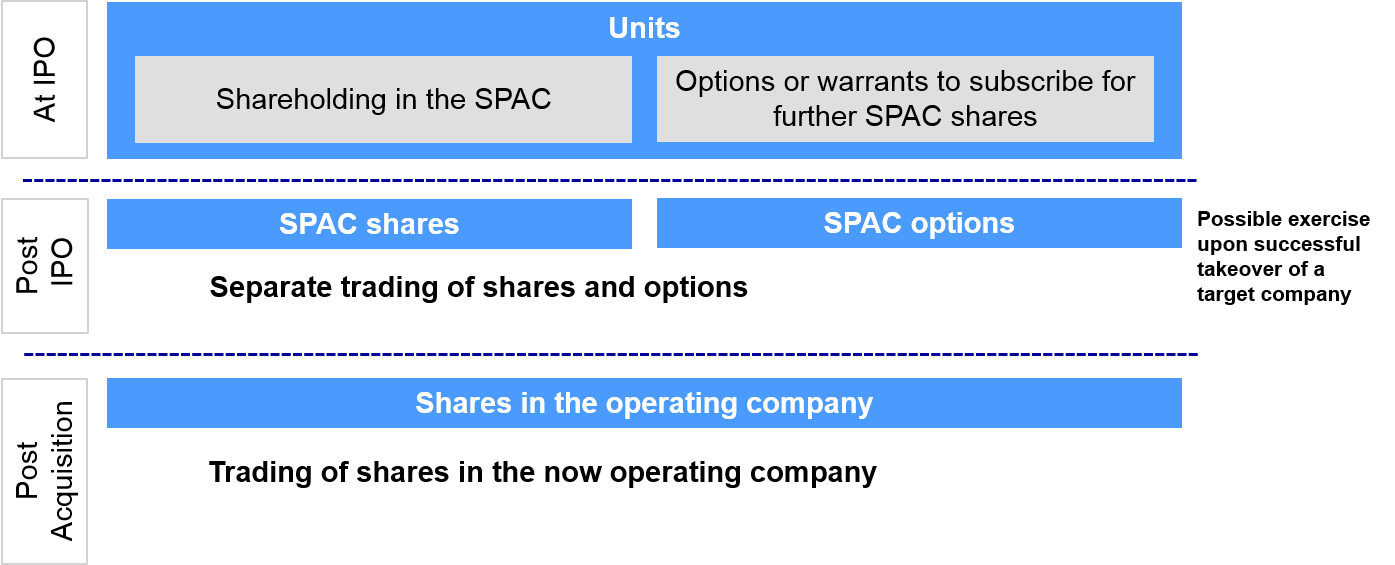

- Initially linked compound securities (units) are issued, which consist of an ordinary stock and, as a rule, a warrant; for structural reasons, the two securities are traded separately shortly after listing.

- The warrants can usually be exercised following the acquisition of a target or, at the latest, within a maximum period of usually four years following the listing, and they entitle the holder to acquire further stocks at a fixed issue price.

2. Basic admission requirements

- In principle, the issuer of shares eligible for admission to trading must have existed as a company for at least three years and have disclosed its financial statements for the three financial years preceding the application in accordance with the rules applicable thereto (cf. Section 3 (1) BörsZulV).

- As this is usually not the case with a SPAC, the management board will allow the shares to be admitted, notwithstanding the above stated rule, if it is in the interest of the issuer and the public to do so (cf. Section 3 (2) BörsZulV). The management board may make a discretionary decision in this regard. For the admission of SPACs, the Frankfurt Stock Exchange has hitherto exercised its discretion in individual cases and decided in favour of admission to the Regulated Market if all of the following conditions were met:

- The proceeds of the issue is paid into an interest-bearing escrow account.

- The intended use of the proceeds of the issue is detailed in the prospectus.

- The SPAC provides evidence that its existence will be limited to a fixed period of time and that in the event of its liquidation, the assets in the escrow account will be returned to the investors, and it is ensured that the use of the assets in trust is decided with a shareholder majority of at least 50 per cent.